3DACN, 3D Augmented Convolutional Network for Time Series Data

Abstract

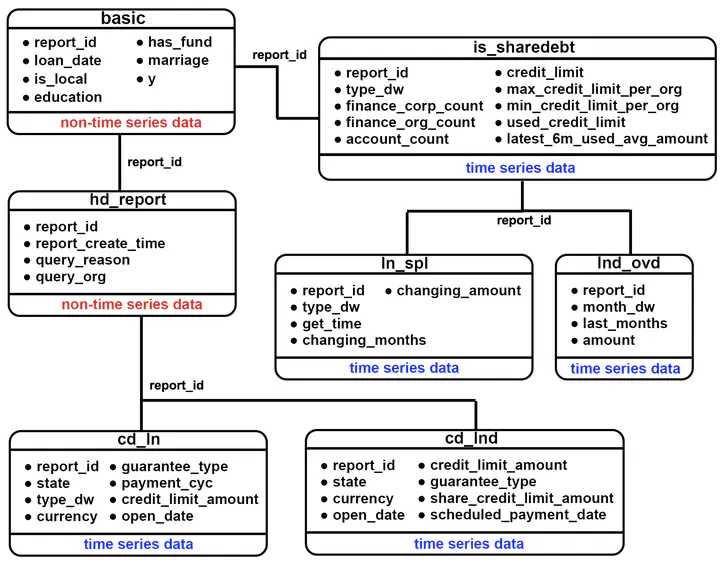

Time series data and non-time series data is increasing in the credit system of financial market, so that an effective and intellegent data mining model plays a critical role to analyze big data. We propose a three dimensional and augmented convolutional network (3DACN) to extract the value concatenation with time series information from the parallel structure of GRUs and FCs. For hybrid time series data, there are much more samples in a specific class, and the ratio is up to 93.1%. Thus, the serious imbalanced problem causes the algorithm failing to converge. Due to the imbalanced problem, it’s necessary to enhance the 3D convolutional network by an augmented algorithm on time series data. 3DACN ensures the latent variables with an Expectation-maximization algorithm to improve F1 score (F1) and Area Under Curve (AUC). Experimental results show that in the benchmark of credit risk database, the 3DACN can reach a high performance on F1 up to 88.1% and the AUC up to 88.4%; while in the benchmark of bank database up to 81.1%, 88.2% respectively.